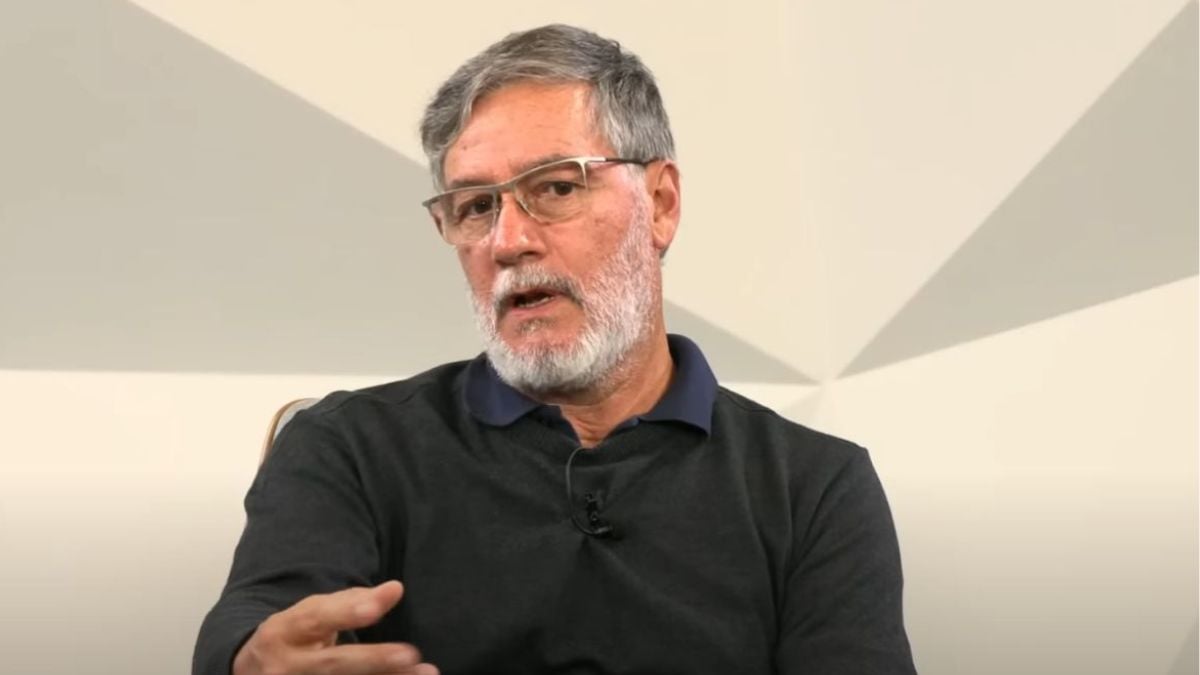

With a proprietary strategy, Werner Roger challenges the market and explains how his approach goes beyond traditional methods (Image: Reproduction)

Going against the market, Werner Roger challenges traditional approaches and reveals his secret to creating real value in his panel 'The best small caps from the perspective of a market pioneer', which took place during Small Caps Masters 2024, an event promoted by Market Makers.

At the head of Trígono Capital, he made his Trígono Flagship Small Caps fund appreciate 270% since its creation in 2018 — eight times more than the Ibovespa in the same period. In the panel, the manager commented on his differentiated method of investing, focusing on small caps.

Proprietary philosophy: the 'Werner way' of investing

Werner emphasized that his strategy goes beyond traditional methodologies, such as discounted cash flow and the EBITDA multiple, incorporating an analysis of economic value added (EVA), ESG and other factors that differentiate the evaluation of companies in the manager's portfolio.

One of the central characteristics of the 'Werner way of investing' is the high concentration in companies with strong conviction. “We have more or less 30 companies in the portfolio, but the top 10 represent 85% of the assets under Trígono’s management,” he stated. He highlighted that this concentration is a strategy to reduce risk, contrary to the common sense of extreme diversification.

Furthermore, Trígono uses a bottom-up approach, starting with the analysis of company performance, instead of focusing on macroeconomic factors, as many managers who adopt the top-down model do. For him, the most important thing “is the company’s results. You start from the company’s profit, the result,… and look upwards until you reach the macro”.

Werner also shared the importance of dividends in the total return on stock investment. He mentioned that in small caps, most of the gains come from dividends: “We did a study with 25 small caps and found that 80% of the return came from dividends and only 20% from share appreciation,” he stated.

Although the Brazilian market still does not attribute much weight to ESG in share prices, the manager believes that this works as a “teleprotection, because if there is a governance problem, an environmental problem, a social problem, a scandal, we try, in a way , protect yourself.”

Werner also spoke about the importance of principles when making investment decisions, demonstrating that his choices go beyond numbers and graphs. For him, ethics and coherence are essential factors in asset selection. “There are companies that don’t even enter the analysis. It's not a question of price. It's principle. Either you have a principle or you don’t,” he states, reinforcing the need to align investment strategies with solid values.

EVA: why isn’t growing up enough?

On the panel, the manager gave a real lesson on economic value added (EVA) as an essential tool for measuring value creation in a company, when considering the cost of invested capital.

He highlighted that EVA assesses whether a company is effectively generating returns greater than its cost of capital. “Basically, it is the cost of capital, how much it costs me, the return on invested capital”, he explained.

Roger highlighted that, to calculate the indicator, it is necessary to weigh the return generated by the company's assets in relation to the capital invested, whether its own or third parties. And he mentioned companies like WEG (WEGE3), which finance their operations with their own resources, have a higher cost of capital, but still manage to create value.

Additionally, he criticized many companies' focus on EBITDA growth while ignoring the impact of the cost of capital. “The market doesn’t look, it only looks at the EBITDA, the margin, the growth… but it doesn’t look at the cost of capital”, he warned.

He also pointed out that growing and increasing EBITDA are relatively simple tasks, but creating real value for shareholders is the real challenge. “Because it is very easy to achieve EBITDA, grow, gain market share, growth is easy. Now, how much you return, how much you create value for the shareholder.”

To learn more about this methodology and how it can transform investment evaluation, guarantee your access to watch Werner Roger's panel in full.

Check out everything that happened at Small Caps Masters 2024

Roger was just one of the highlights of the event, which also included the participation of Welliam Wang, from AZ Quest, and Giuliano Dedini, from 4UM Investimentos, and added up to more than three hours of dense content on strategies and tactics for investors who want to get rich through of small caps.

The event opened the 'black box' of small caps and revealed the new theses and expectations of this investment category, preparing investors for the current scenario and showing the opportunities that cannot be missed.

If you missed the live event, don't worry. Market Makers is making the recording of the three panels available in full for you to watch at your leisure. To receive access, all you need to do is register on the event's official page.

And there's more: when you sign up you will also have access to the exclusive ebook “Market titans – Strategies and secrets of the biggest small cap investors in Brazil” with the secrets of 7 great minds in the Brazilian market.

This is the best way for you to stand on the shoulders of giants when it comes to small caps. Therefore, if you want to increase your portfolio's return potential and 'surf' the same strategies that the biggest experts are using, sign up now to watch all the details of Small Caps Masters 2024.

Don't miss this opportunity to learn from those who understand the subject without paying anything for it. Click on the link below to secure your passport for this knowledge.