Recommended portfolio for this month was updated with 'more defensive theses', according to the responsible analyst; check it out (Image: iStock.com/Bosca78)

Invest in shares of McDonald’s (NYSE: MCD; B3: MCDC34) may no longer have its advantages. This is, at least, the opinion of analyst Enzo Pacheco, from Empiricus Research, an analysis house belonging to the BTG Pactual group.

The analyst maintained the shares of the technology giant fast food in its recommended BDR portfolio for seven consecutive months, since February this year. When the end of September arrived, he understood that it was time to leave the thesis – and replace it with papers from another sector of the economy.

'I don't really love it all'? Why not invest more in McDonald's, according to analyst

In his report yesterday (01), presenting the recommended portfolio for October, Enzo explained the reasons:

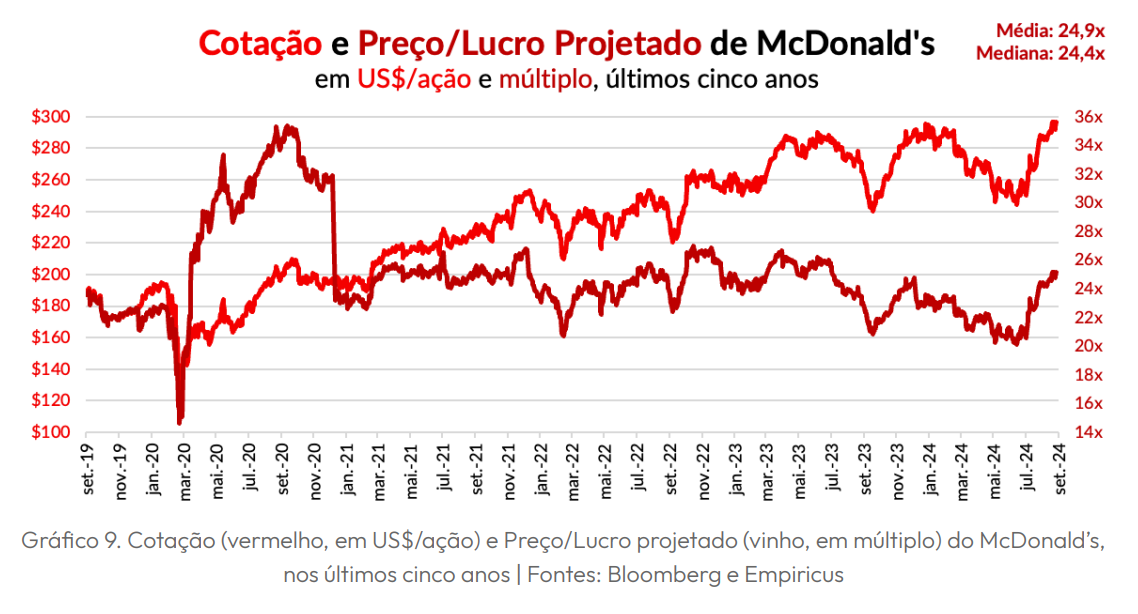

“I understand that the risk-return relationship in the asset is no longer so advantageous. (…) The two times the stock reached its current price level, we subsequently saw drops of around 15%. (…) Even though recent promotions have brought consumers back to their stores, I understand that the potential for appreciation on paper is not worth the risk.”

Yesterday (01), McDonald's shares closed the NYSE trading session at US$302.98. The graph below shows in fact that, shortly after the last time it reached this price, the stock depreciated:

The stock that replaced McDonald's (MCDC34) in the recommended portfolio

The stock chosen to replace McDonald's in Enzo Pacheco's recommended portfolio was UnitedHealth (NYSE: UNH; B3: UNHH34), one of the world's largest operators of health plans.

Enzo saw the vacancy in the portfolio as an opportunity to bet on protection against possible “falls” after the optimistic phase that the American stock market is currently experiencing.

Although the latest figures for the American economy were good enough for the Fed to cut the basic interest rate there, caution is still necessary, according to the analyst:

“Although inflation is no longer the Fed's main concern, it cannot be completely ignored given the geopolitical issues we have been observing in recent years. (…) Because (health) is an essential service, we increased the portfolio’s exposure to more defensive theses, in case the economic numbers show a worsening beyond what the Federal Reserve expects.”

Furthermore, Enzo also highlights that UnitedHealth will be one of the first companies to release its numbers in the next earnings season (3Q24), already in the middle of this month, and the expectation is to “continue showing satisfactory numbers to shareholders”, he stated.

Realize that the objective is to exchange one thesis for another thinking about being ready for the next foreign scenarios, but never stop positioning yourself on the American stock market. Regardless of the state of the economy, investing in American stocks remains essential.

'There's no excuse' for not investing in US stocks

In an interview with the Giro do Mercado program (from Money Times) on August 2nd, well before the interest rate cut in the USA, Enzo already stated:

“Given the practical ways we have today (of investing), (…) there is no excuse for not having international investments.”

The USA continues to be the largest economy in the world, and its stock exchanges continue to be home to companies with the highest market value globally – highlighting the big techs such as Apple, Microsoft and Nvidia.

The important thing is to pay attention to market sentiments and identify the best strategies, but without forgetting to have part of the portfolio exposed to the dollar, the strongest currency in the world.

This strategic vision is the responsibility of market analysts, who thus guide individual investors to the best investment decisions.

Check out the full recommendation: the best American stocks for this month

If you want to know all the best international shares for this month from Enzo Pacheco's perspective, Money Times offers you how courtesy for you – enough click here to check.

In addition to the two BDRs mentioned in the text, the portfolio has eight other recommendations from different sectors of the economy: from a e-commerce even an oil company. The objective is to seek the best bets on the international market, regardless of sector.

Remembering that you just need to click this linkor the button below. Good investments!