Before the Fed: Wall Street and the dollar are falling in anticipation of a rate cut

Moments before the Federal Reserve's decision was announced, the New York stock exchanges were operating without a clear direction, but mostly in decline:

- S&P 500: +0.02%, at 5,635.69 points

- Dow Jones: -0.02%, at 41,597.98

- Nasdaq: +0.07%, at 17,641.17 points

Yields on U.S. Treasury bonds are rising. Projected interest rates for the 10-year T-note are up to 3.685%; for the 30-year T-note, they are up to 3.993%.

The dollar is falling. The DXY, which compares the US currency to a basket of six strong currencies, is down 0.04%. Compared to the real, the dollar is trading at R$5.4830 (-0.09%).

The Ibovespa fell 0.45% to 134,358.54 points.

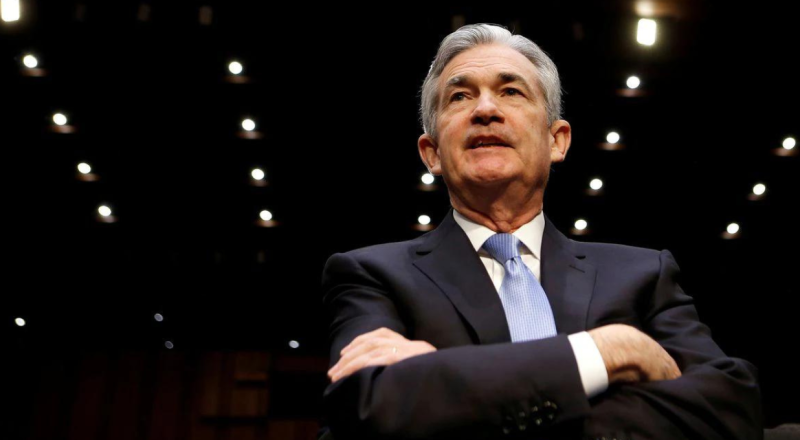

The Fed is expected to cut interest rates for the first time in more than four years and begin monetary easing.

Os traders see a 59% chance that the central bank will set interest rates in the range of 4.75% to 500% per year, according to the CME Group's FedWatch monitoring tool. Yesterday (17), the probability was 64%.

The probability of the Federal Reserve (Fed) cutting 25 basis points, which would put US interest rates in the range of 5.00% to 5.25% per year, is 41%, compared to 36% the day before.