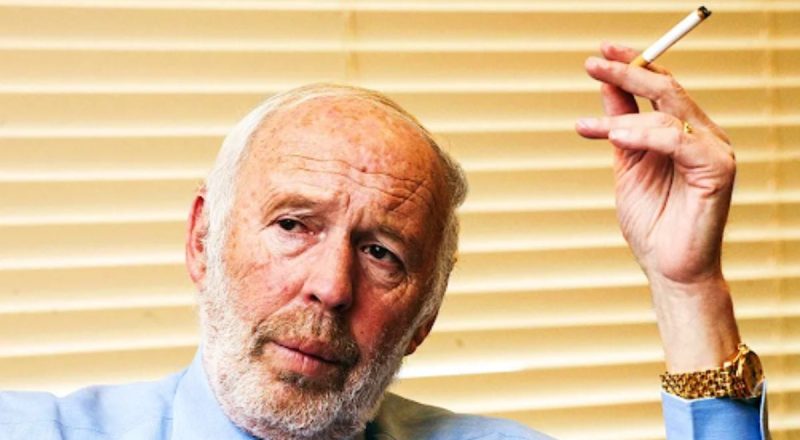

Find out how the legacy of Jim Simons, the great MIT mathematician, is behind a tool that simplifies stock market investments (Image: The Capital Advisor)

Jim Simonsthe legendary MIT (Massachusetts Institute of Technology) mathematician who achieved the incredible milestone of +66% average return per year for 30 consecutive years, he passed away in May of this year.

Despite his passing, his investment strategy is more alive than ever. This same mathematical model was replicated by a renowned Brazilian company no bouquet trading.

The software created by the company has been enabling recurring gains on the Stock Exchange for a series of investors – even the most beginners.

To give you an idea, the tool was programmed at the factory to search earnings of R$680 per dayon average (with just 3 clicks).

Unlike Simons' more famous fund, the Medallionwhich only a few investors had access to, this technology was developed to be completely accessible to anyone.

With 3 clicks on the screen of your cell phone (or computer), you put the computational force “anointed” by quantitative analysis e deciphered by the mathematician-investor to “work” for you.

Inspired by biggest “money making machine” of all timeo Gamma Quant It has been attracting market attention due to its efficiency and usability.

Discover the 'secret' behind the R$31.8 billion fortune of Jim Simons, known as the 'King of Quant'

Unlike some of the greatest investors in history, such as Warren Buffett, Ray Dalio, Peter Lynch, among others, Jim Simons used his knowledge of mathematics to create something unique.

He challenged the 'investment status-quo' by following a different path than classic patterns of the great investors of the time.

“There are few people who have truly changed the way we view markets”Theodore Aronson, founder of AJO Vista, a quantitative management house, told Bloomberg Markets magazine in 2008.

It was through his expertise in interpreting mathematical patterns that he eschewed the common standards of investment managers in favor of quantitative analysis.

In this way, Simons found patterns in data that predicted asset price changes. His technique was so successful that he became known as the “Rei do Quant”.

In 1992, the mathematician inaugurated the Medallionhis fund that used this 'secret' to capture profits in the financial market. Result: your average profitability reached +66% per year for 3 consecutive decades.

This is how Simons became multibillionaire. He had a fortune estimated at US$31.8 billionwhich made him the 49th richest person in the world, according to the Bloomberg Billionaires Index.

Fortunately, the mathematical “secret” behind its billion-dollar operations was copied by hundreds of large companies – including here in Brazil.

As previously mentioned, the objective of this Brazilian company is to grant accessibility to validated investment method – which was previously the privilege of a few mathematical geniuses.

Through an intuitive interface, the investor-user of the Gamma Quant operates with unbelievable ease. But don't be fooled. Behind this machine are ultra-complex equations that capture data at the “speed of light”.

I.e, thanks to this toolit is no longer necessary to be a numbers genius to seek exceptional returns from the financial market.

It works like this: you “plug” it into your investment account, define your risk profile and it works semi-automatically for you.

Let's be clear: this does not mean that you will multiply your capital exponentially like Jim Simons did and even surpass the biggest fund of all time, Medallion.

However, you can have the chance to seek significant profits using technology inspired by the same mathematical model as the “King of Quant”.

See how you can test the quantitative system inspired by the Jim Simons model to seek profits

Before knowing how you can test the system yourself by “plugging it” into your investment account, you must be aware of 2 important factors:

- Access to the software will be granted after an online meeting;

- Access spaces are limited.

That said, it is highly recommended that you make your register for the online meeting now – that is if you are willing to allocate a part of your capital that you will not need on a daily basis, after all, every investment includes risks. It is also not recommended to compromise your emergency fund.

During the meeting, the full earning potential that Gamma Quant offers to its users will be presented. Like these below:

Past returns do not guarantee future profits. Like any investment, investing in variable income has its risks.

However, without risks, great investors would not have gotten where they are, and more importantly: there would not have been the possibility of great returns. Good risk management is essential for you to seek satisfactory results with the financial market.

To experience this chance to seek an extra average income of R$680 per day with Gamma Quant, simply click the button below: