The real estate market is in a cycle of ups and downs. See the impact of Minha Casa, Minha Vida. (Image: Getty Images/ Canva Pro)

O GDP Brazil's economy grew 1.4% in the second quarter of the year, exceeding market expectations, which projected an increase of 0.9%. This result was the strongest since the fourth quarter of 2020.

At this rate, projections for GDP expansion for the year should be close to 3% compared to the 1.59% projected by the Focus report in January.

Therefore, I bring relevant observations on this topic inspired by a text by José Urbano Duarte:

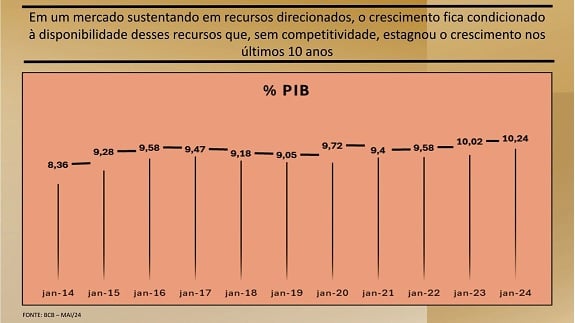

“The real estate market has been in a state of decline for 10 years. And the reason is not a lack of demand or an inability to produce and offer more. Nine out of ten real estate purchase and sale transactions regularly carried out in the Brazilian market are carried out with traditional housing financing. In this context, it is easy to say that the market is not growing, especially because financing conditions are preventing it.”

GDP growth in the construction industry

The current condition of the country that affects the dynamics is objective and structural, unlike the previous ones that had a more cyclical profile.

Any measure that does not address the structural challenge will be palliative. Important, but palliative. Still inspired by the words of José Urbano Duarte, the release of compulsory reserves is relevant, but not the solution as a whole.

Financing production with market resources is also a temporary and risky measure, as it offers a short-term solution and requires 1.5 times more targeted funding than that allocated to production.

Regarding the structures, he mentions two.

The first is the secondary market, which requires the renunciation of some exclusive profitability assumptions, especially when one has a short-term vision focused only on the product (financing/financial agents). This can represent a significant change in the way the business is viewed, especially for developers and construction companies.

The second is the need to focus on traditional funding, and it is essential to direct the two main funds clearly according to their main purpose. FGTS must continue to be aimed at the low-income (popular) public, while Savings must serve the Middle and High Income (MAP) segment.

How Real Estate Can Take Advantage of Rising GDP

There are many advantages to increasing GDP, but we will only be able to take advantage of them if we are prepared. In this context, companies must adopt some strategic measures to ride this wave, instead of just watching it.

The first is to invest in analyzing the demand for real estate. Here, management committees must keep an eye on the monitoring of consumption indicators, purchase intentions and population growth in the regions. From this, it is possible to understand what the market demands: whether it is affordable housing, mid-range or high-end luxury.

Another important point is to carry out a feasibility and input price study.

As demand for real estate increases, the demand for construction materials follows suit — which has a significant impact on prices. Cement, steel, and glass are the first on the list to be evaluated. Thus, if there are signs that GDP and prices will continue to grow, construction companies may decide to anticipate material purchases or adopt practices that reduce dependence on traditional inputs.

We must not forget to keep a close and cautious eye on these moments. It is interesting to carry out a macro risk analysis, as GDP growth scenarios may be accompanied by volatility in other areas, such as inflation, exchange rates or political pressures.

So, there is nothing better than taking precautions and making a careful assessment of the risks involved in the projects, considering both GDP growth and other macroeconomic factors.

The challenge behind further growth

Regarding funding, one of the main points is the need to adopt a proactive stance, prioritizing planning and processes instead of reacting to anticipated emergencies. This is even more so in a context that affects both the sustainability of access to housing and the predictability of the sector.

Promoting a broad discussion on structural, consistent measures that generate permanent results is essential. Few sectors of our economy have as much impact on the population as the construction industry, whether in the environment, innovation or job creation at different levels.

In a country like Brazil, where the housing deficit is seven million people, creating mechanisms that reduce the cost of capital for real estate credit lines is a good solution.

If we really want to change the graph above to promote significant growth, it is necessary that the current agendas are prioritized by all those involved in the sector. But it is even more important that structural issues receive due attention.

The winds need to blow in our favor. May they not decide to change direction!