Simulator shows personalized options based on the investor's objective and risk profile (Image: iStock/cokada)

It is common for Brazilians, when they are in doubt about where to invest, to resort to products that are closer to their daily lives. Thus, most leave their money in savingsor else, in accounts of digital banks which usually offer returns of at least 100% of the CDI.

However, what many people don't remember is that it is possible to achieve considerably greater gains with more sophisticated options of traditional investments, without giving up security and liquidity.

If you want to know what the ideal options are for you to boost your assets and seek higher returns than savings and CDI, you are in the right place.

Because Money Times, in partnership with BTG Pactual, the largest investment bank in Latin America, has developed a investment simulator able to assemble a complete and personalized wallet for you, with “premium” assets that can deliver above-average returns.

The good news is that the simulator is free and is available to any Brazilian. To run your simulation and find out which is your ideal portfolio, just click the button below.

It beat savings and CDI by a landslide: simulator shows ideal allocation to seek greater multiplication of assets

Let's say you are an investor with a conservative profile (focus on security) and your main objective is increase equity in 10 years.

Furthermore, let's assume that you have R$50,000 as an initial investment, and that you will invest an additional R$1,000 per month.

The Investment Simulator made the calculations and showed the projected return on your investment in savings, CDI and your ideal portfolio. See the result:

In the ideal scenario, at the end of 10 years, you would have a total of:

-

- R$ 247.180,77 com a savings

- R$ 293.105,92 com 100% do CDI

- R$ 349,251.20 with the personalized wallet

Note that the personalized portfolio suggested by the simulator exceeded R$300,000, yielding 19.15% more than the CDI and 41.29% more than savings.

This was only possible due to the selected premium products through the simulator, which created an ideal portfolio to offer security and profitability to the investor.

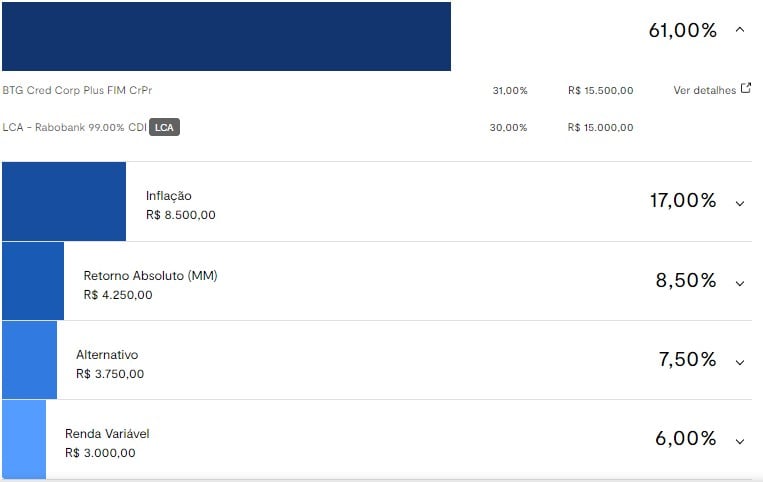

See the recommended portfolio in the simulation as an example:

Source: Money Times Investment Simulator and BTG Pactual

For conservative investors, the portfolio shows that it is possible to seek attractive returns by investing mainly in fixed income.

In this case, 61% of the suggested allocation is made up of products of this type, with 31% in a fixed income investment fund and 30% in an LCA (Agribusiness Credit Letter).

It is important to keep in mind that the composition of the portfolio changes according to the profile (conservative, moderate and bold), the investor's objectives (increasing wealth, saving on income tax, financial security, among others), the amount of capital involved and the investment period.

So, do your simulation to get a personalized wallet for you.

*This material is not related to specific investment objectives, financial situation or particular needs of any specific recipient, and should not serve as the sole source of information in the investor's decision-making process. Before making a decision, the investor should carry out, preferably with the help of a duly qualified professional, a thorough assessment of the product and its risks in light of their personal objectives and risk tolerance (suitability).