According to Evercore, Harris promotes renewable energy theses, while Trump would call for more defensive actions; exclusive event discusses future post-American elections (Image: Facebook/Donald Trump/Kamala Harris – Money Times Montage)

The elections for the presidency of the United States remain surrounded by uncertainty even as they draw closer to their end.

Investors around the world want to understand the next economic movements after November 5th, so that their portfolios do not miss investment opportunities or are negatively impacted.

There are analysts who prefer to state that there is not much to do (other than wait), while others deliver more concrete projections for the economy and the American stock market.

The consultancy of investment banking North American Evercore fits into this last group. After listening to market analysts, the company published, at the beginning of this week, a specific list of shares whose prices could rise in the scenario of victory of each of the candidates for the White House.

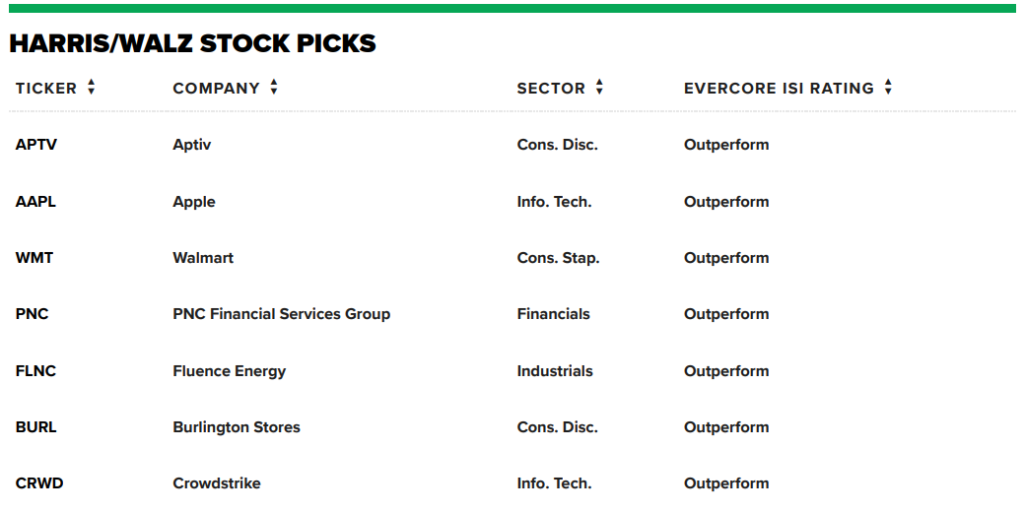

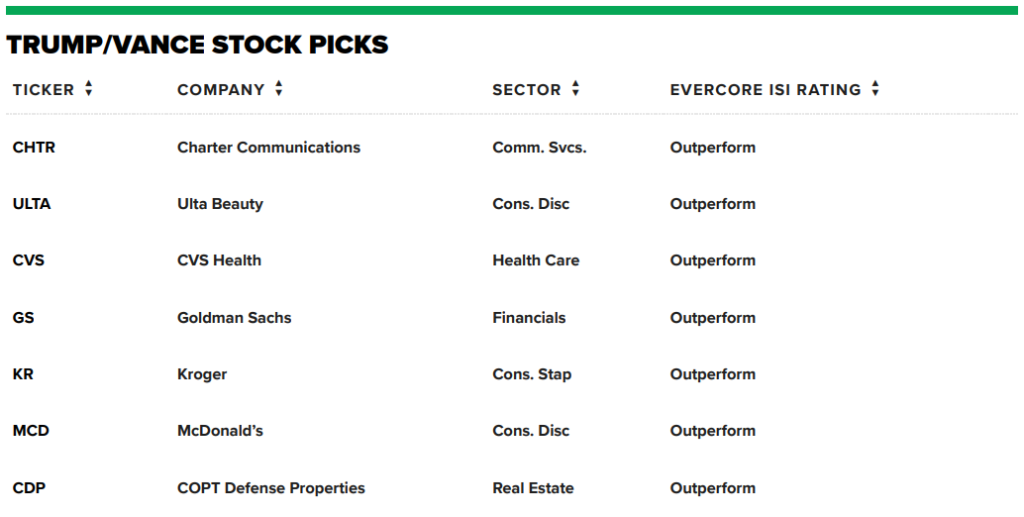

The list comprises seven actions if Donald Trump is elected, and another seven if Kamala Harris wins.

The 'winning' portfolio if Kamala Harris is elected

In an interview with CNBC, one of Evercore's directors, Julian Emanuel, stated that he believes that actions linked to renewable energy may increase in value if Kamala Harris is elected. This is because the Democratic party is historically more favorable to the cause.

This is the case of Aptiv, company providing electrical systems for automobiles that is at the top of the list made by analysts.

Despite this, Evercore's list is diverse and includes names like Apple, Walmart and a regional bank, PNC.

For the latter, comments obtained by CNBC mention the bank's potential to deliver good results in the next reporting seasons – but do not make it clear why a Democratic government would be more favorable.

Predictions if Donald Trump is elected

For a possible victory for Donald Trump, Evercore selected stocks from sectors that would benefit from a less regulatory environment, in addition to more defensive theses.

This is the case of names such as the bank Goldman Sachs, a real estate company (COPT Defense Properties), Charter Communications, a telecommunications company, and retailers such as CVS and Kroger.

Empiricus analyst has similar predictions for the American stock market

On the Brazilian side, Matheus Spiess, analyst at Empiricus Research, an analysis house for the BTG Pactual group, has a similar opinion to Evercore's main theses.

According to him, a possible Kamala Harris government would be more beneficial to the renewable energy, health and biotechnology theses, due to the “more progressive approach” of the Democratic party.

Donald Trump, on the other hand, has a greater appeal to more traditional industries, such as oil and gas, and could be a “more inflationary” government, which justifies defensive theses on the stock market.

Despite everything, the American stock market should remain firm

Spiess states that the North American stock exchange should not see major changes in its foundations, regardless of who wins:

“We stay here discussing 'one or the other', but the truth is that, historically, regardless of who wins, (there is) volatility in the short term, but then (the stock market) 'takes off'”.

These are just predictions – the matter is far from over

It is worth remembering that the actions presented in this text are “merely illustrative”, so that the investor has an idea of what the market is thinking.

Some of them do not even have BDRs registered with B3 and Brazilian investors would need to open an account abroad to access them.

And if you, a Brazilian investor, want to understand what all this could mean for our economy and the local stock market, we invite you to a meeting with experts who will answer your questions.

Market Makers, one of the largest hubs of financial content in Brazil, will dedicate its next special event exclusively to this topic.

Sign up for Market Makers' American Elections special

The forum “American Elections: the future at stake”, Made in partnership with Seu Dinheiro, it will bring together the biggest Brazilian names in international relations and global investments in one place.

Between the 15th, 16th and 17th of October, the event will hear guests such as:

- Marcos Troyjo, diplomat and former president of BRICS Bank;

- Roberto Dumas Ladies, professor of macroeconomics at Insper and FIA Business School;

- Andrew Reider, investment director at WHG and economist from Harvard University; and more.

Best of all, the event is 100% online and free. You don't pay a cent to hear what big names have to say on the subject.

If you want to participate, just click hereor the button below, to reserve your place: