(Image: iStock/Leila Melhado)

A Brandeswith almost 50 years of existence and more than US$ 100 billion under management, reduced its shareholding in Embraer (EMBR3) to 9.99%, shows a document sent to the market this Friday (20).

- Neither PETR4 nor BRAV3: BTG Pactual's “main sector choice” for oil is another; see here

With this, the American manager now holds 74 million shares of the company.

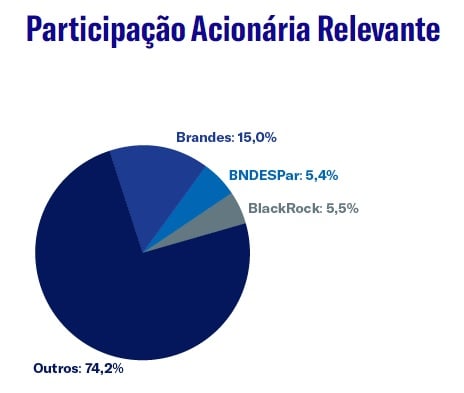

According to Embraer's IR, Brandes held around 15% of the company's shares and was the largest individual shareholder of the Brazilian giant.

See below:

The manager informed that the sale does not aim to change the composition of control or the administrative structure of Embraer.

Embraer: Buy low, sell high

Brandes held a 15% stake in Embraer since July 2019, according to this statement. At the time, the stock was trading at R$19. Since then, the stock has soared 158%, according to data from Google Finance.

This year, the stock has been breaking records amid a good operating moment. Deliveries have exploded, while profits have increased 50% in the second quarter.

The company's order book (backlog) rose 20% in the second quarter from the same period a year earlier to reach $21.1 billion — a seven-year high.

Analysts remain confident that the rally is not over. According to the Itau BBAin a recent report, Embraer will have a profit of US$ 303 million this year (compared to a projection of US$ 234 million) and US$ 332 million in 2025 (previous expectation was US$ 247 million).

“We still see potential for the shares, after the strong operational momentum led to a reclassification of the case,” said analysts Daniel Gasparete and team, who signed the report.

Master de Benjamin Graham

Charles Brandes founded Brandes in 1974 after a meeting with Benjamin Graham, considered the father of value investing.

In practice, the investment strategy consists of finding shares that are being traded at a price below their intrinsic value, that is, cheap, and buying them at that moment.

According to the manager's official website, when the bear market of 1973-1974 created attractive long-term opportunities for disciplined and patient investors, Brandes decided it was time to launch his own management company.

Since then, the company has remained independent and applied the philosophy.